Surety Bond Specialists

Experience the difference of working with a specialist.

At Catalyst Surety Partners, we use our team's past experience as bond underwriters and our trusted relationships with 30+ surety providers to advocate for your business. Let us roll up our sleeves and get to work for your next job, and the next, and the next.

Need a Bond Quickly? You're in the Right Place.

Common Contractor Bond Questions.

100+ Years

There's over 100 years of industry experience behind our team.

50 States

We're licensed to write bonds in all 50 states (plus D.C.).

> 650 Contractors

We've helped over 650 contractors improve their bonding.

> 30 Surety Markets

We work with over 30 highly-rated surety carriers.

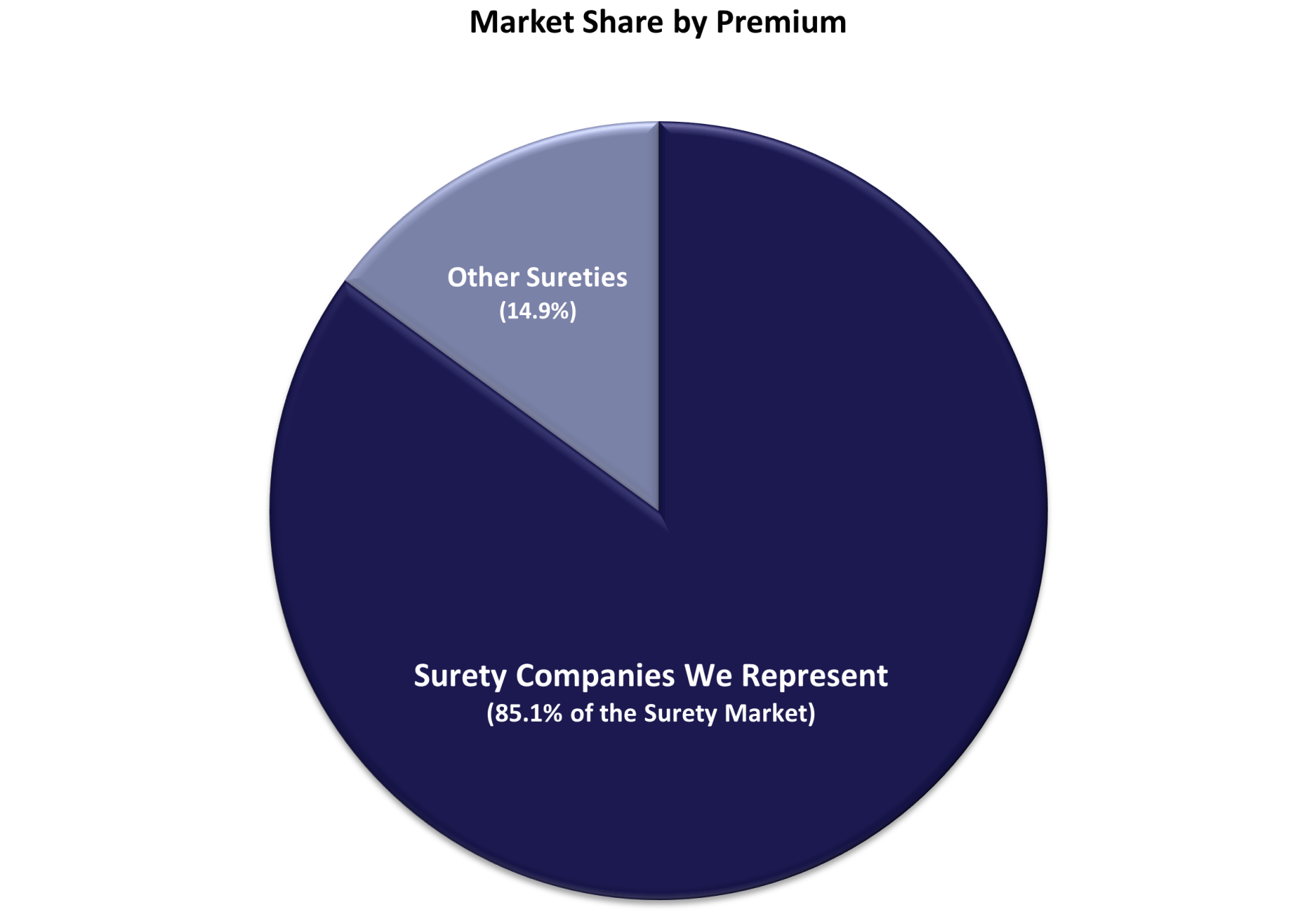

Leverage the Power of Our Surety Partners

The strength of surety solutions that any agency can provide rests largely in their access to the surety companies that underwrite and financially back the bonds. We represent over 30 different surety underwriting companies, which collectively provide us with access to over 85% of the entire surety market based on premium volume. The diversity of sureties we partner with allows our agency to provide robust solutions for clients of any size or type.

Your Catalyst For Growth

We want to know you, not just your paper trail. We go to bat for businesses we believe in, thus we want to have a deep understanding of your business plan. If your plan is to grow, we arm you with a suite of resources and industry insights to help you on your growth journey. Below you can navigate to some of our resources that help you position for growth.