Catalyst Construction Economics Hub

Know where the industry is.Know where it's headed.

Data Which Reflects Where the Industry Is Today

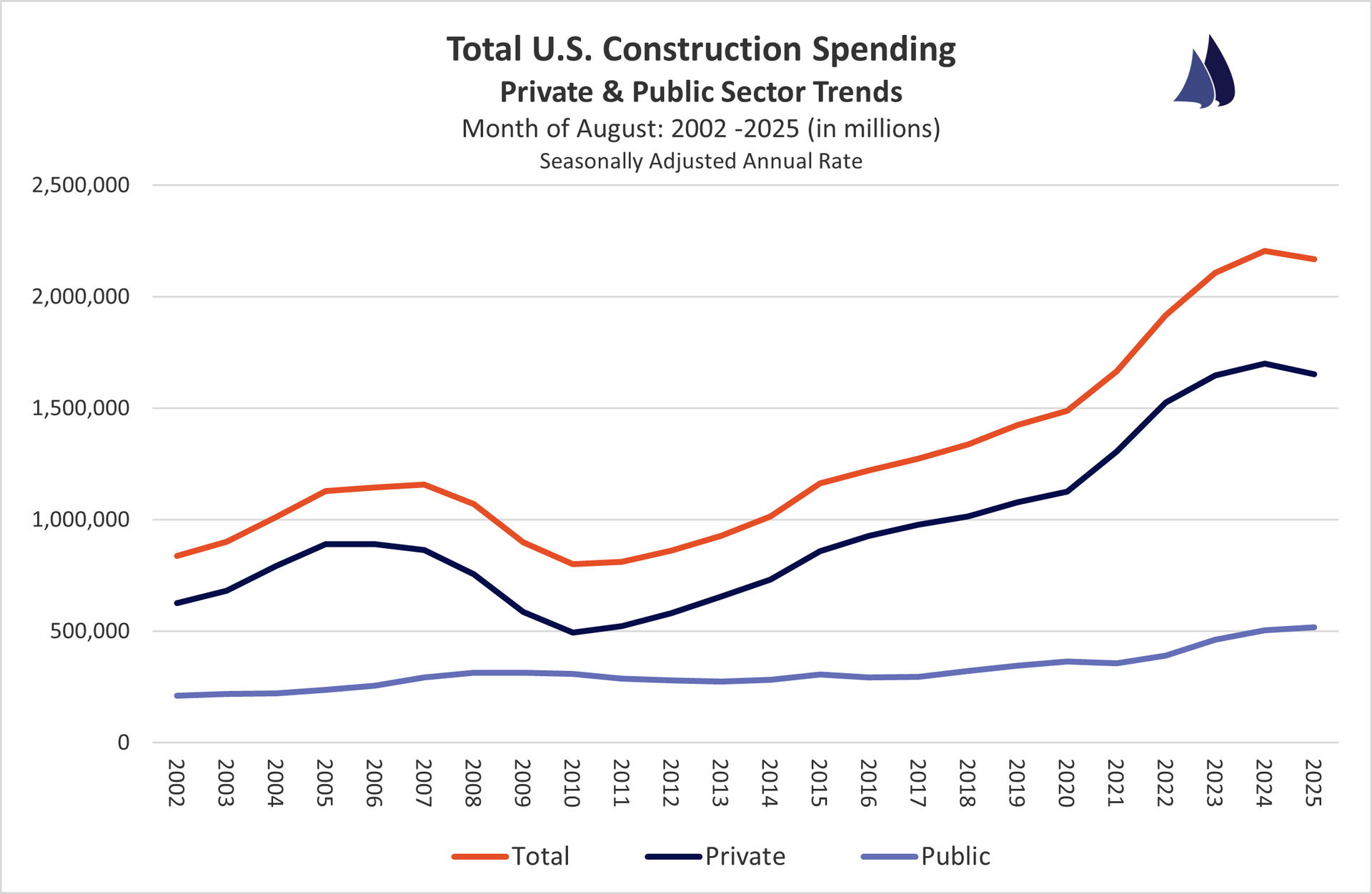

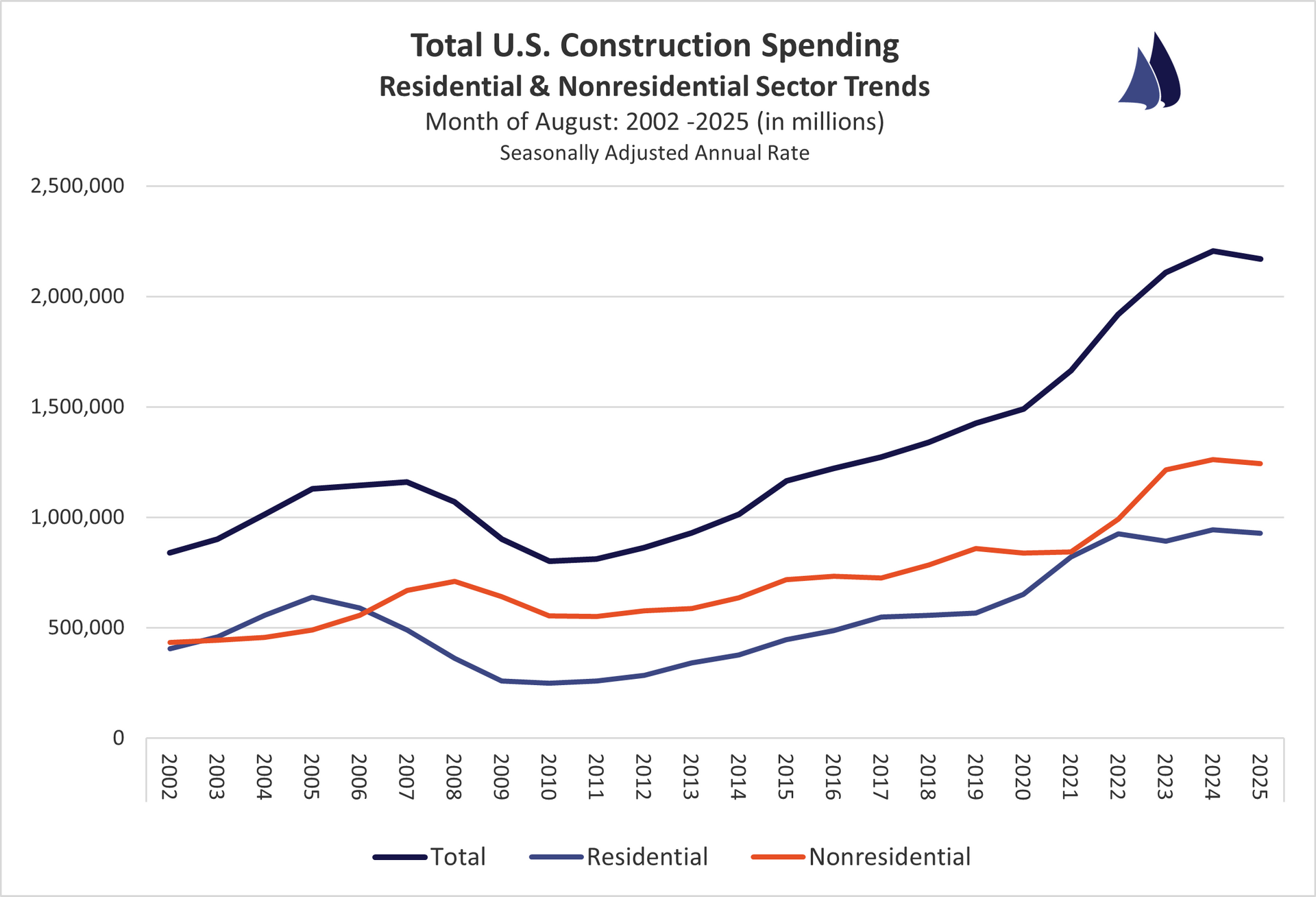

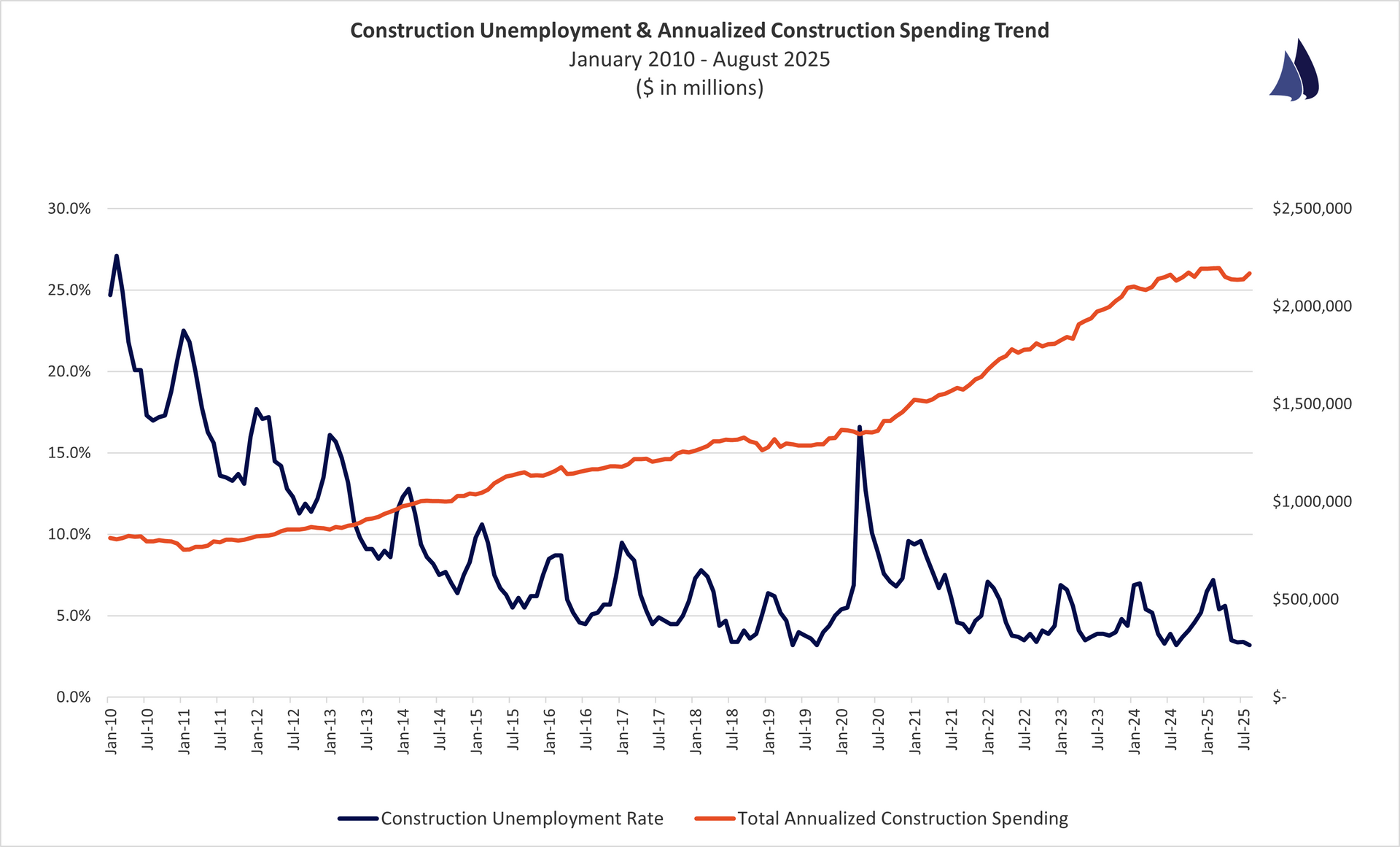

Construction Spending

U.S. Census Bureau - Construction Spending

Year-To-Date Annual Total - Seasonally Adjusted Annual Rate

August 2025 vs. August 2024

** New spending data is not scheduled to be released until January 2, 2026.**

All Construction Spending: -1.6%

Public Construction: +2.7%

Private Construction: -2.9%

Residential Construction: -1.8%

Non-Residential Construction: -1.5%

Quick Analysis:

Construction spending in August 2025 slipped slightly compared to August 2024, with total expenditures down 1.6% year-over-year. The decline was driven primarily by the private sector, where spending fell 2.9%, including a 1.8% drop in residential construction and a 1.5% decline in non-residential work. In contrast, public construction continued to show strength, increasing 2.7% and providing a steady source of project activity. Overall, the data reflects a market where government-funded projects are propping up demand while private owners and developers remain more cautious.

Notable Increases/Decreases By Type:

- Sewage and Waste Disposal - Spending is up 8.2% versus 2024

- Water Supply - Spending is up 3.3% versus 2024

- Commercial - Spending is down 7.5% versus 2024

- New Multifamily - Spending is down 7.1% versus 2024

https://www.census.gov/construction/c30/c30index.html

Construction Costs

ENR Construction Cost Index

December 2025 vs. December 2024

Total Construction Costs: +3.6%

Building Cost Index: +4.2%

Material Cost Index: +2.5%

Skilled Labor Costs: +5.7%

Common Labor Costs: +4.0%

Quick Analysis:

ENR reported total construction costs as up 3.6% year-over-year in mid-December. Labor cost increases have accelerated in the later months of 2025.

http://enr.construction.com/economics/

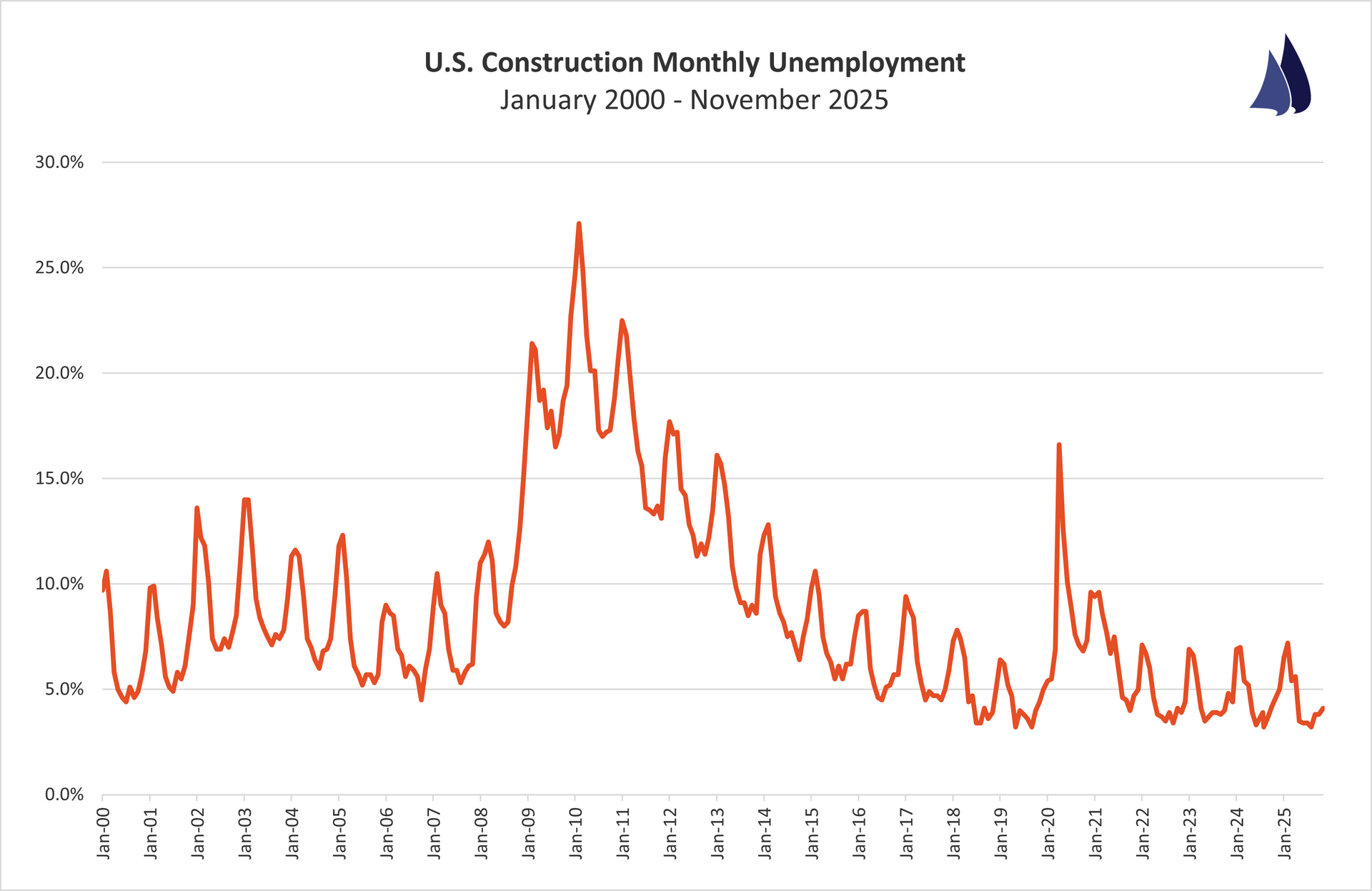

Construction Employment

U.S. Bureau of Labor Statistics

November 2025

Construction Unemployment: 4.1%

Quick Analysis:

In November 2025, construction unemployment came in at 4.1%. Based on this data, employment is tighter across the construction industry than the prior two years - where the industry's unemployment rate for November was 4.6% and 4.8%. This is driving the uptick in labor costs that the above ENR data is reflecting.

http://data.bls.gov/timeseries/LNU04032231?data_tool=XGtable

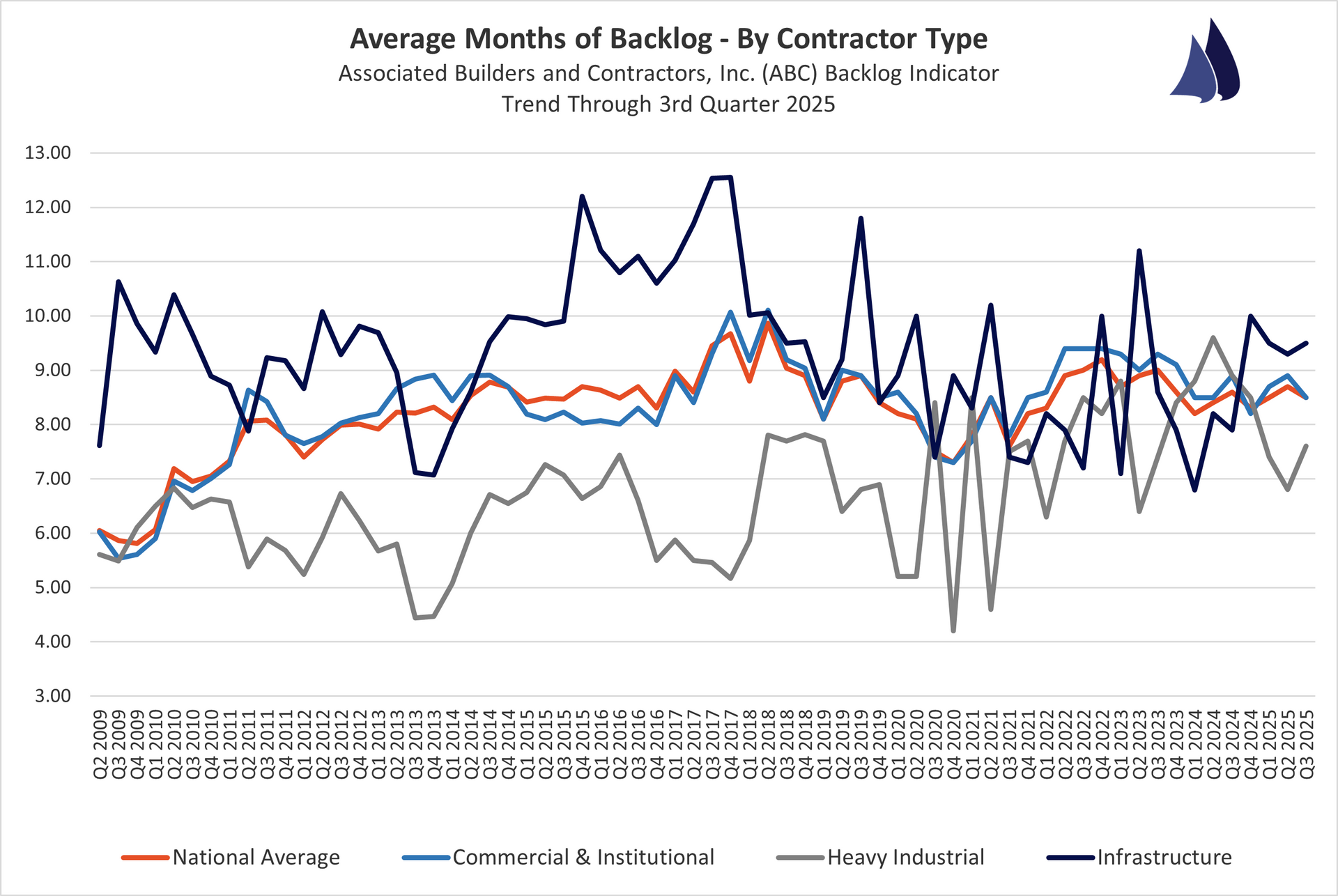

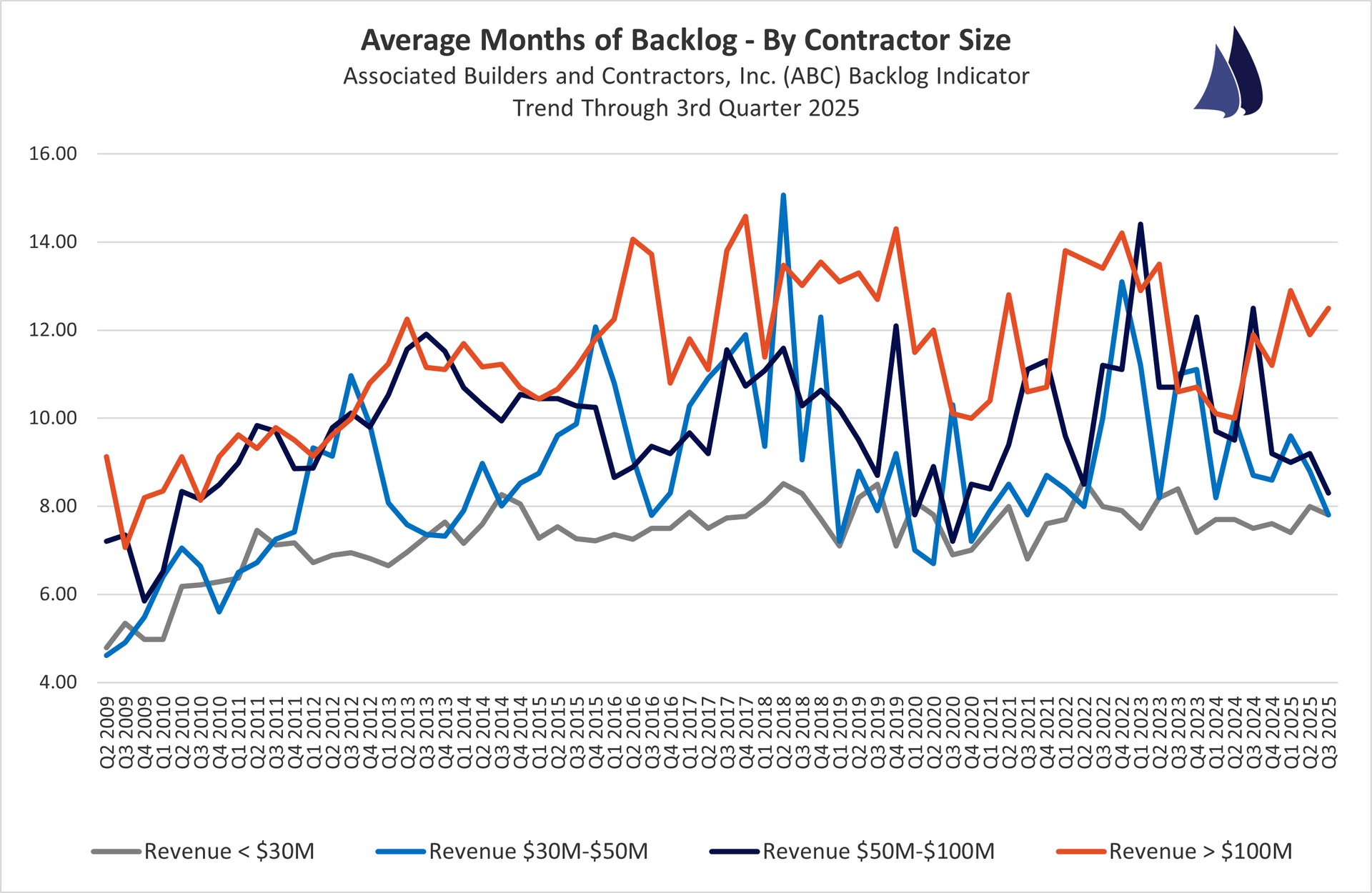

Contractor Backlogs

ABC Backlog Indicator

September 2025 (3rd Quarter)

National Avg. Backlog: 8.5 months

Backlog By Region:

South: 9.9 months | Northeast: 7.6 months | Middle States: 8.6 months | West: 7.5 months

Backlog By Company Revenue:

<$30 Million: 7.8 months | $30-$50 Million : 7.8 months | $50-$100 Million: 8.3 months | >$100 Million: 12.5 months

Backlog By Industry:

Commercial & Institutional: 8.5 months | Heavy Industrial: 7.6 months | Infrastructure: 9.5 months

Quick Analysis:

In September 2025, the Construction Backlog Indicator (CBI) held steady at 8.5 months, down just 0.1 months compared to the previous year. Sector-wise, backlogs declined in the commercial, institutional, and heavy industrial categories but rose notably in the infrastructure segment. Smaller contractors with less than $30 million in annual revenue experienced the sharpest declines, while larger firms maintained or expanded their backlogs. Regionally, backlog strength was concentrated in areas with strong infrastructure and data center development, indicating public-sector and technology-driven projects are sustaining activity nationwide despite broader softness.

http://www.abc.org/NewsMedia/ConstructionEconomics/ConstructionBacklogIndicator/

Data Which Reflects Where the Industry Is Headed

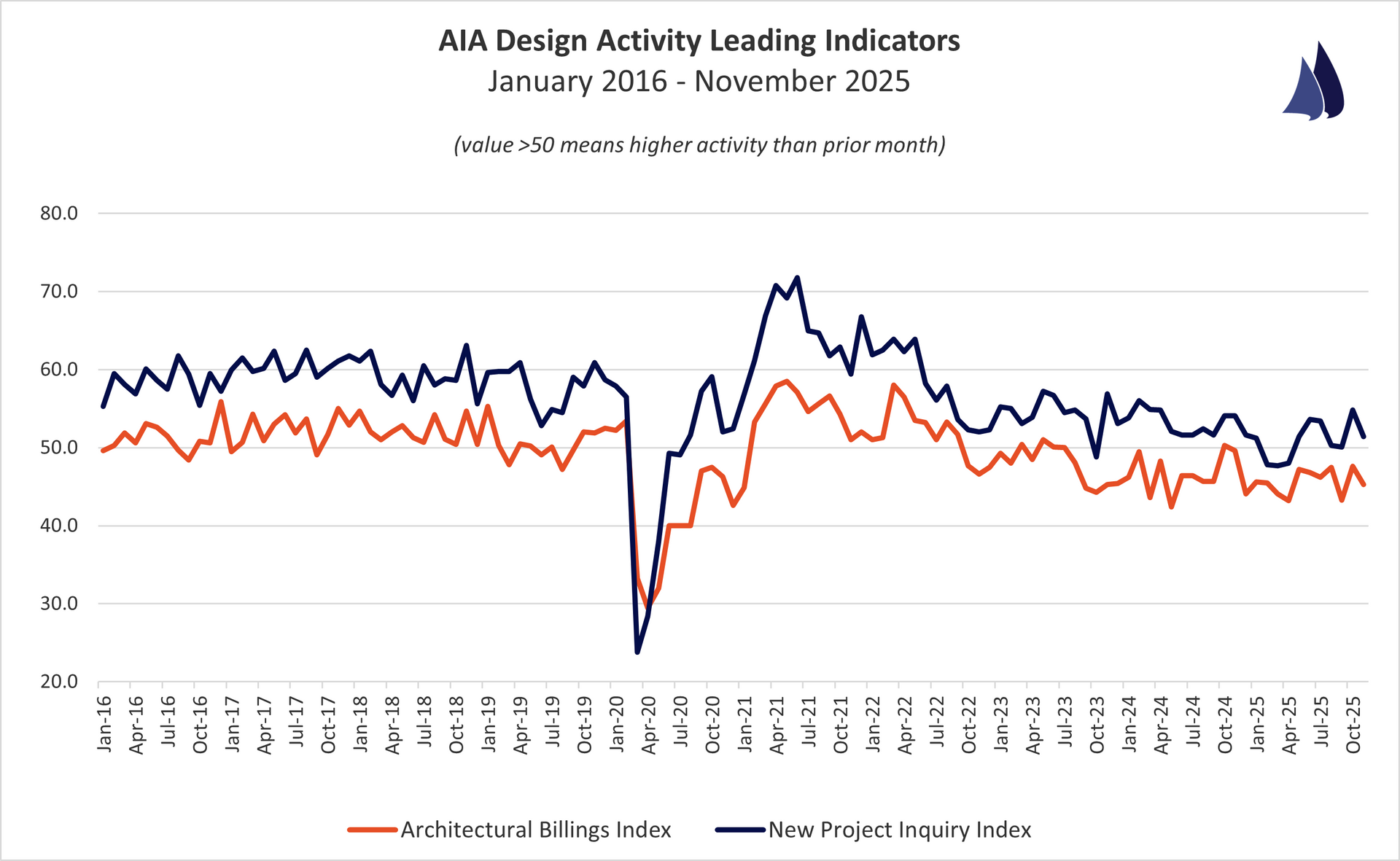

Architectural Billings

AIA Architectural Billings Index

November 2025

Architectural Billings Index (ABI): 45.3

New Design Contract Index (DCI): 42.7

Commercial/Industrial ABI: 45.2

Institutional ABI: 47.6

Multi-Family Residential ABI: 46.6

Mixed Practice ABI: 44.5

South Region ABI: 46.1

West Region ABI: 43.6

Midwest Region ABI: 52.3

Northeast Region ABI: 43.1

New Project Inquiry Index (NPII): 51.4

Quick Analysis:

Index value > 50 represents that architects have reported more activity for that particular metric than the prior month. These metrics are leading indicators as the ABI reflects projects in design that will enter the construction phase in 9 to 12 months and the NPII reflects new project demand from owners to potentially enter the design phase.

Architecture firm billings remained in contraction in November, with the Architecture Billings Index at 45.3, marking the 13th consecutive month below the growth threshold of 50 and signaling continued weakness in design activity. While new project inquiries increased modestly, the value of newly signed design contracts declined, indicating that interest from clients is not yet converting into committed work. Regionally and by practice type, conditions remain broadly soft—with only the Midwest above 50 — suggesting limited near-term momentum for construction starts.

http://new.aia.org/press-releases