Catalyst Construction Economics Hub

Know where the industry is.Know where it's headed.

Data Which Reflects Where the Industry Is Today

NOTE: On January 23rd, 2026, Catalyst hosted Dr. Anirban Basu to gain his insight on the outlook for the 2026 construction economy. Dr. Basu is the Chairman & CEO of Sage Policy Group, Inc., an economic and policy consulting firm headquartered in Baltimore, MD. Dr. Basu currently serves as the Chief Economist at the national level for the Associated Builders and Contractors (ABC). You can access the full recorded video below.

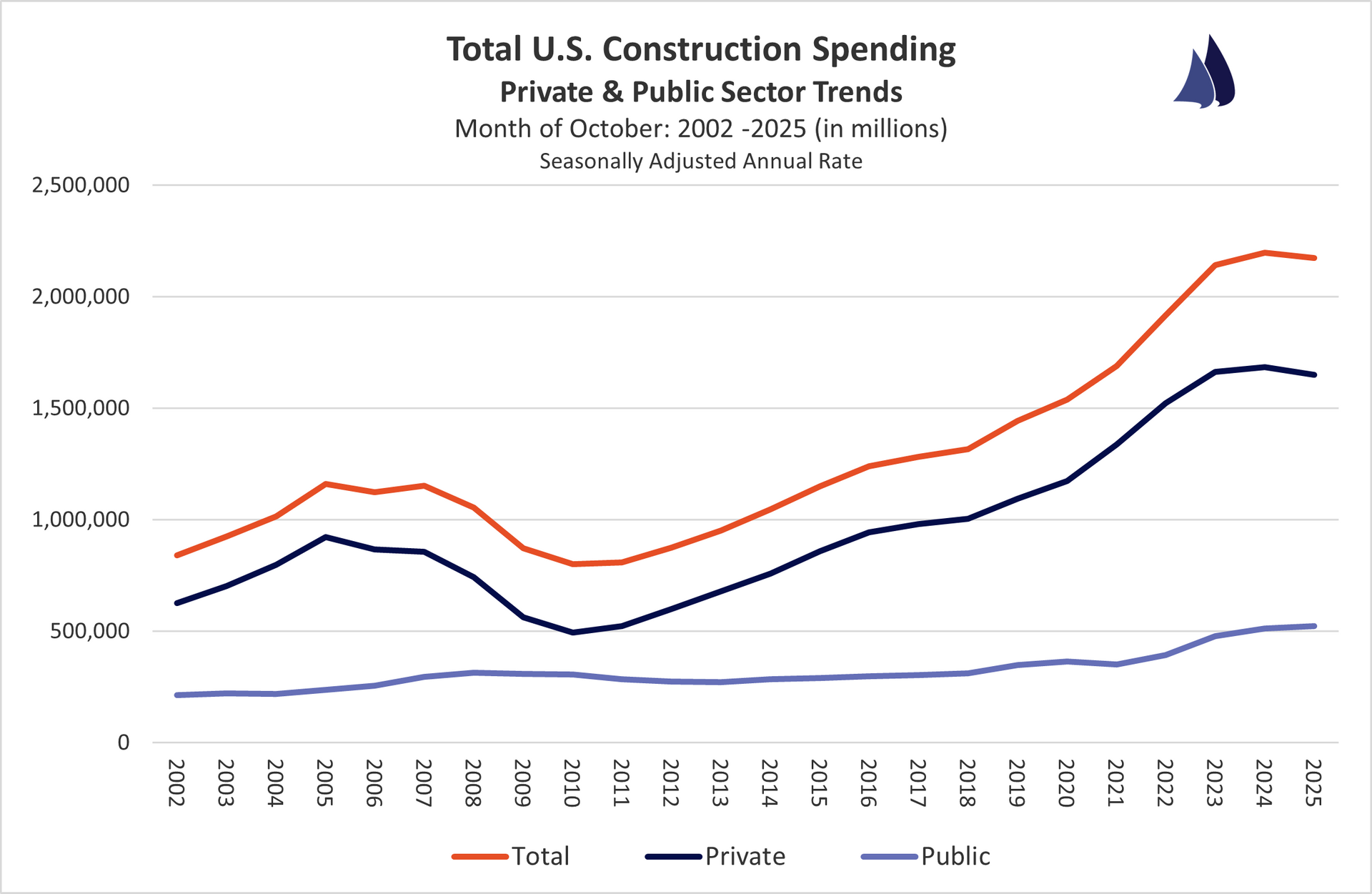

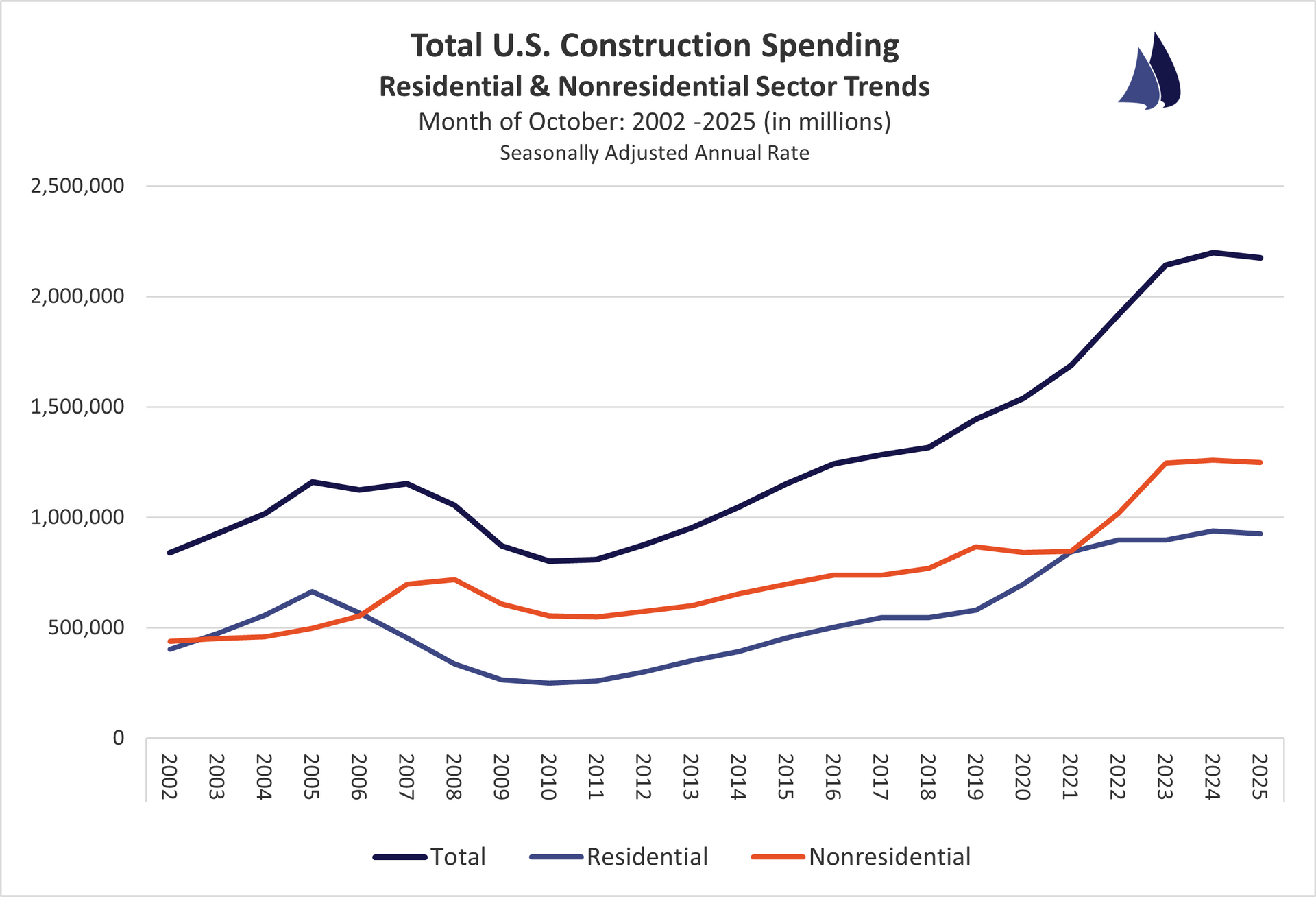

Construction Spending

U.S. Census Bureau - Construction Spending

Year-To-Date Annual Total - Seasonally Adjusted Annual Rate

October 2025 vs. October 2024

All Construction Spending: -1.4%

Public Construction: +3.6%

Private Construction: -2.9%

Residential Construction: -2.4%

Non-Residential Construction: -0.7%

Quick Analysis:

Compared with October 2024, total U.S. construction spending in October 2025 declined by 1.4% year over year, reflecting a modest contraction in overall construction activity. Public construction spending rose 3.6% from a year earlier, partially offsetting weakness in private construction, which fell 2.9% year over year. Within private construction, residential spending declined 2.4% while non-residential construction was comparatively more stable, down just 0.7% versus October 2024.

Notable Increases/Decreases By Type:

- Sewage and Waste Disposal - Spending is up 15.8% versus 2024

- Water Supply - Spending is up 5.0% versus 2024

- Commercial - Spending is down 2.3% versus 2024

- Manufacturing - Spending is down 9.6% versus 2024

https://www.census.gov/construction/c30/c30index.html

Construction Costs

ENR Construction Cost Index

January 2026 vs. January 2025

Total Construction Costs: +2.8%

Building Cost Index: +4.2%

Material Cost Index: +3.1%

Skilled Labor Costs: +5.2%

Common Labor Costs: +2.7%

Quick Analysis:

In January 2026, total construction costs were 2.8% higher than in January 2025, reflecting continued cost inflation across the construction industry. ENR’s Building Cost Index rose 4.2%, driven largely by a 5.2% increase in skilled labor costs alongside a 3.1% rise in material costs. Common labor costs increased 2.7% year over year, reinforcing ongoing wage pressure even outside the skilled trades.

http://enr.construction.com/economics/

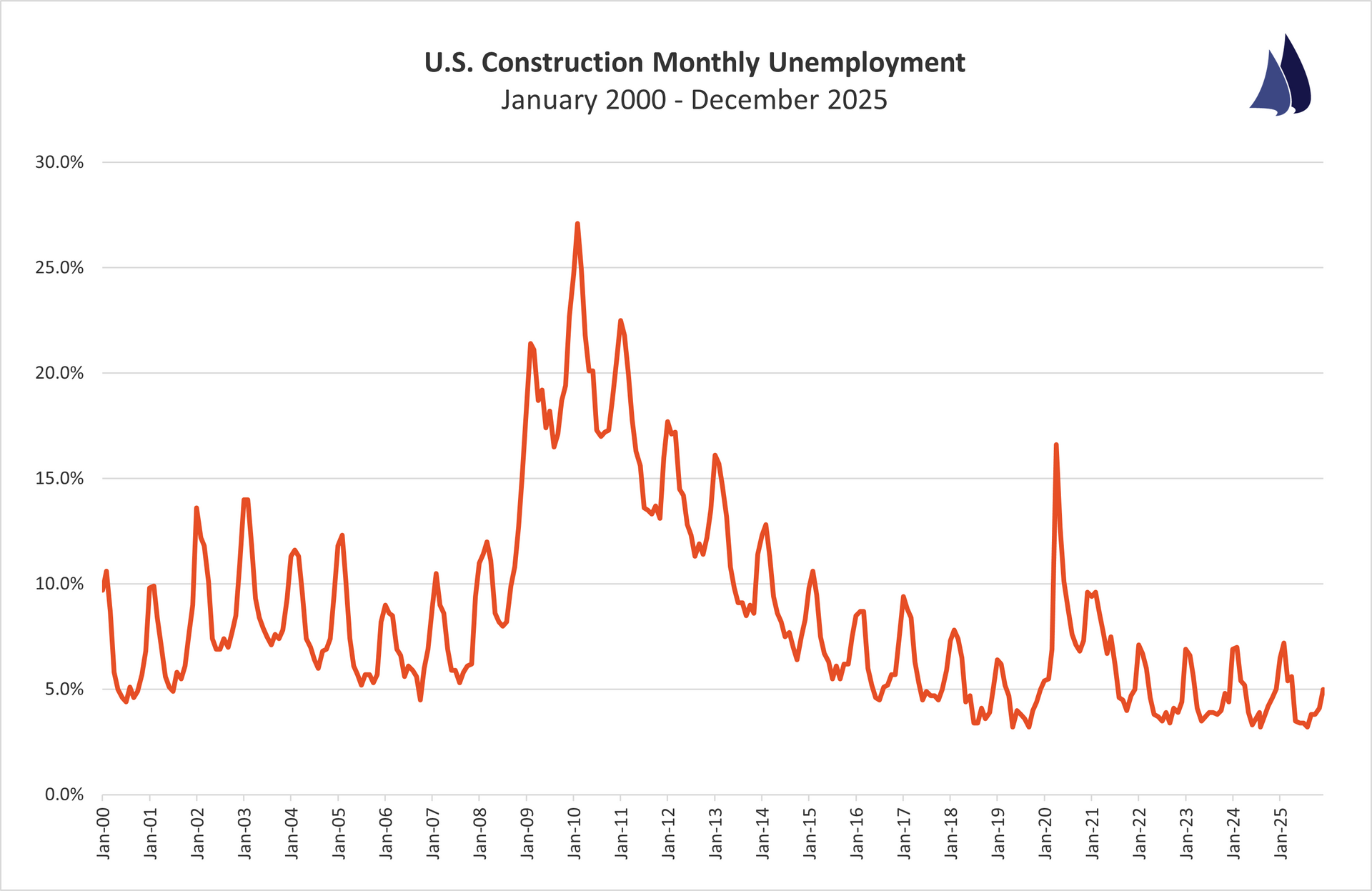

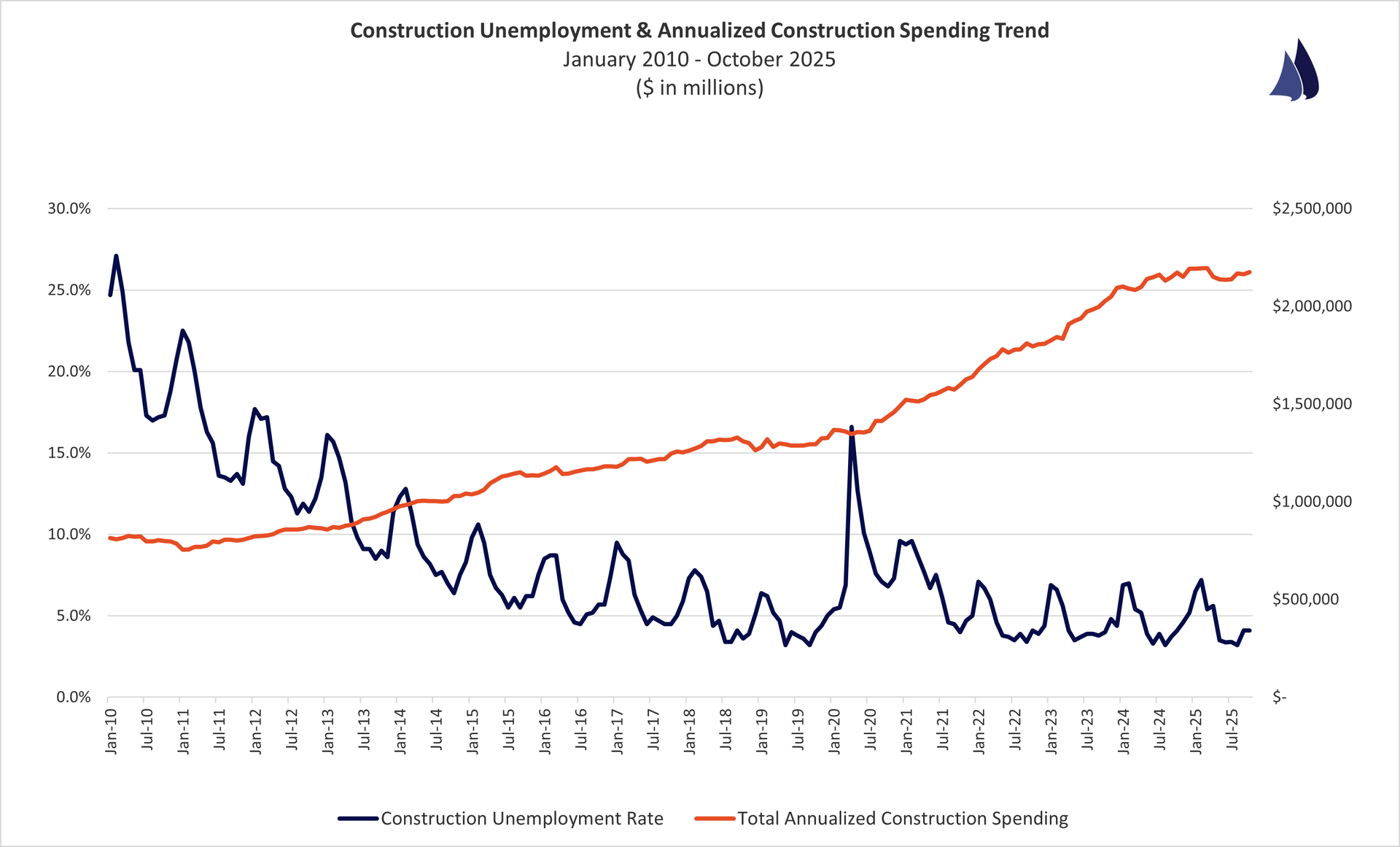

Construction Employment

U.S. Bureau of Labor Statistics

December 2025

Construction Unemployment: 5.0%

Quick Analysis:

In December 2025, construction industry unemployment stood at 5.0%, modestly lower than December 2024’s 5.2%, indicating a slightly tighter labor market year over year. Unemployment rose on a seasonal basis from November 2025, reflecting typical winter slowdowns rather than a structural weakening in construction labor demand. Overall, the year-over-year improvement suggests contractors continued to face relatively constrained labor availability despite softer construction activity in parts of the market.

http://data.bls.gov/timeseries/LNU04032231?data_tool=XGtable

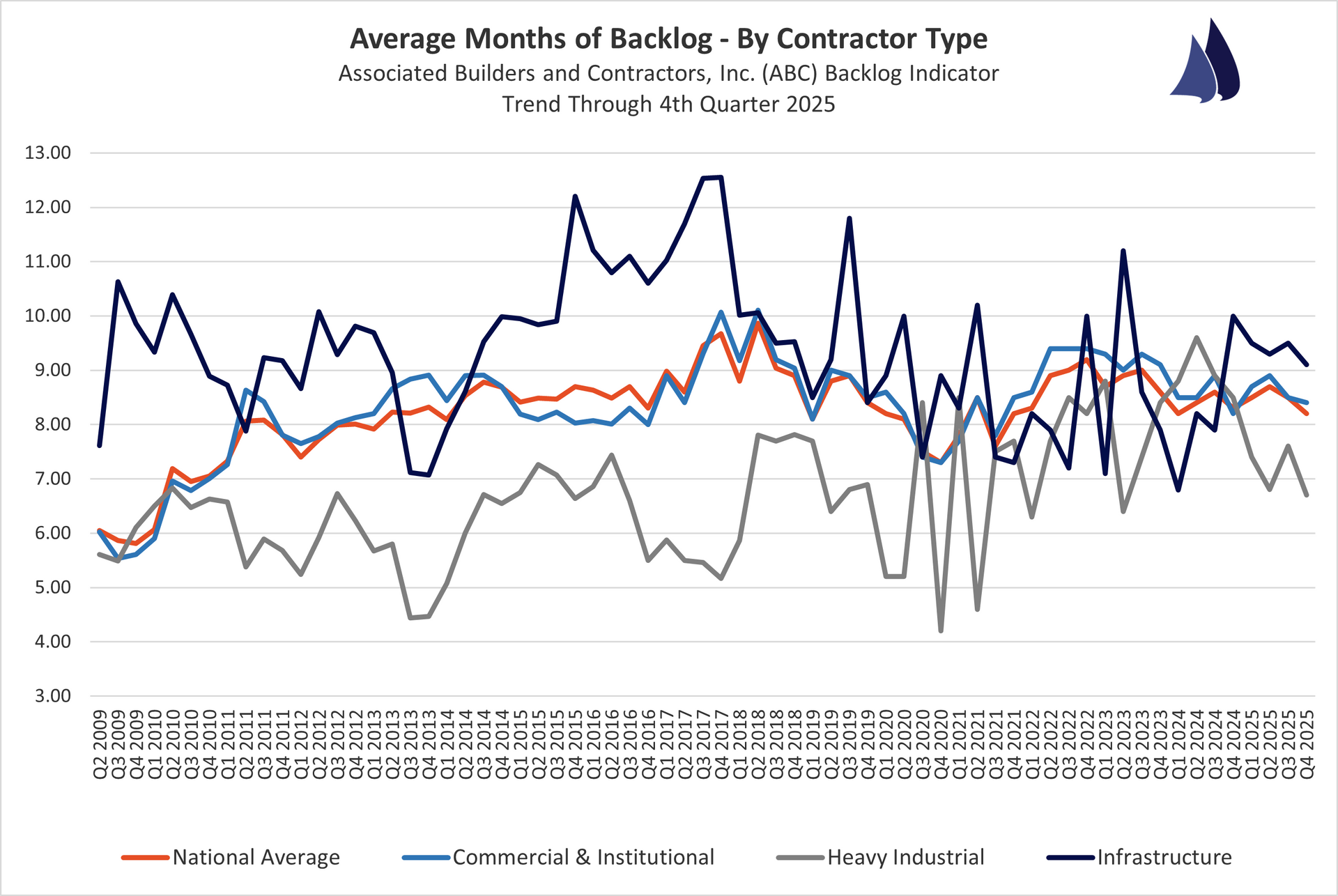

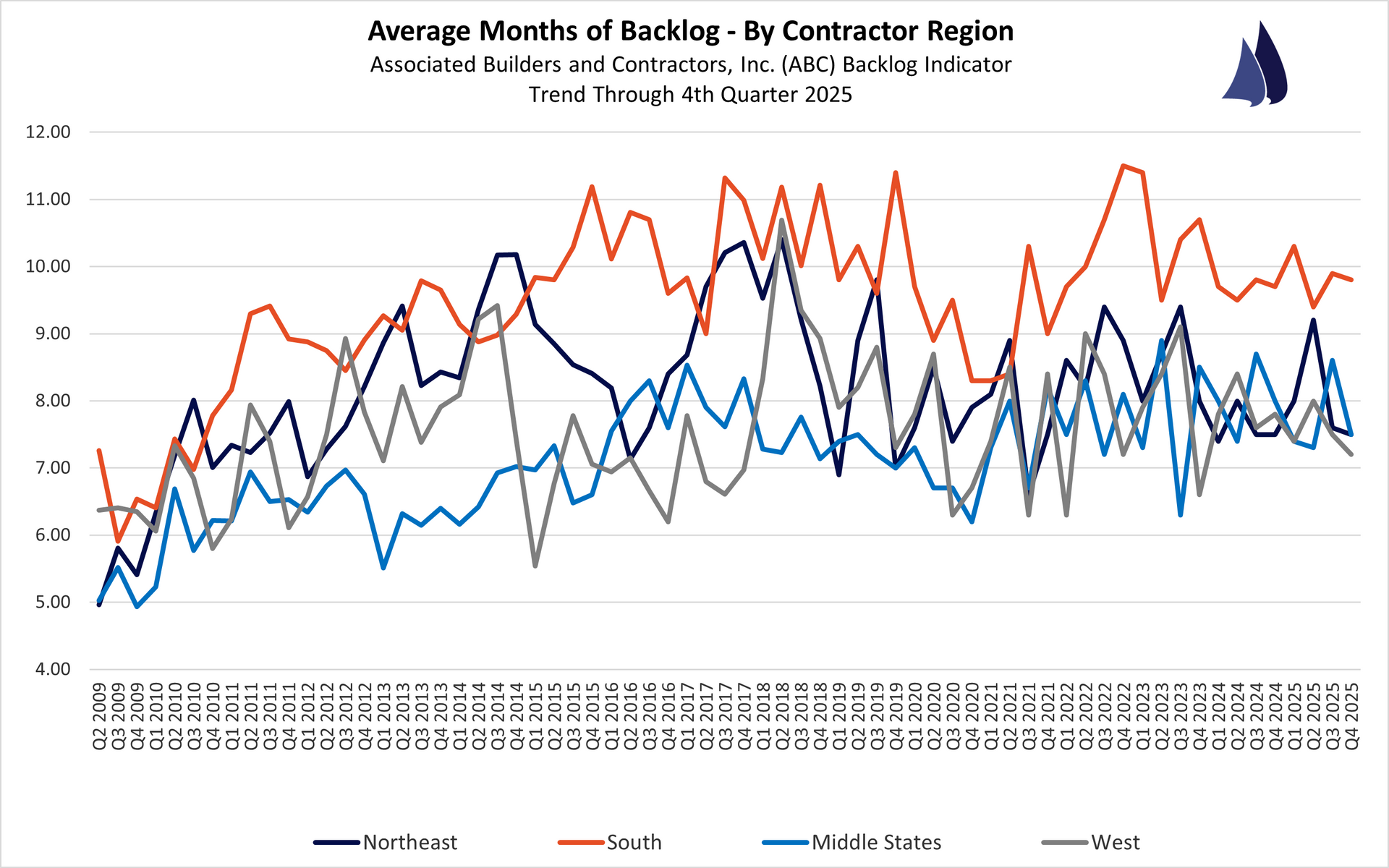

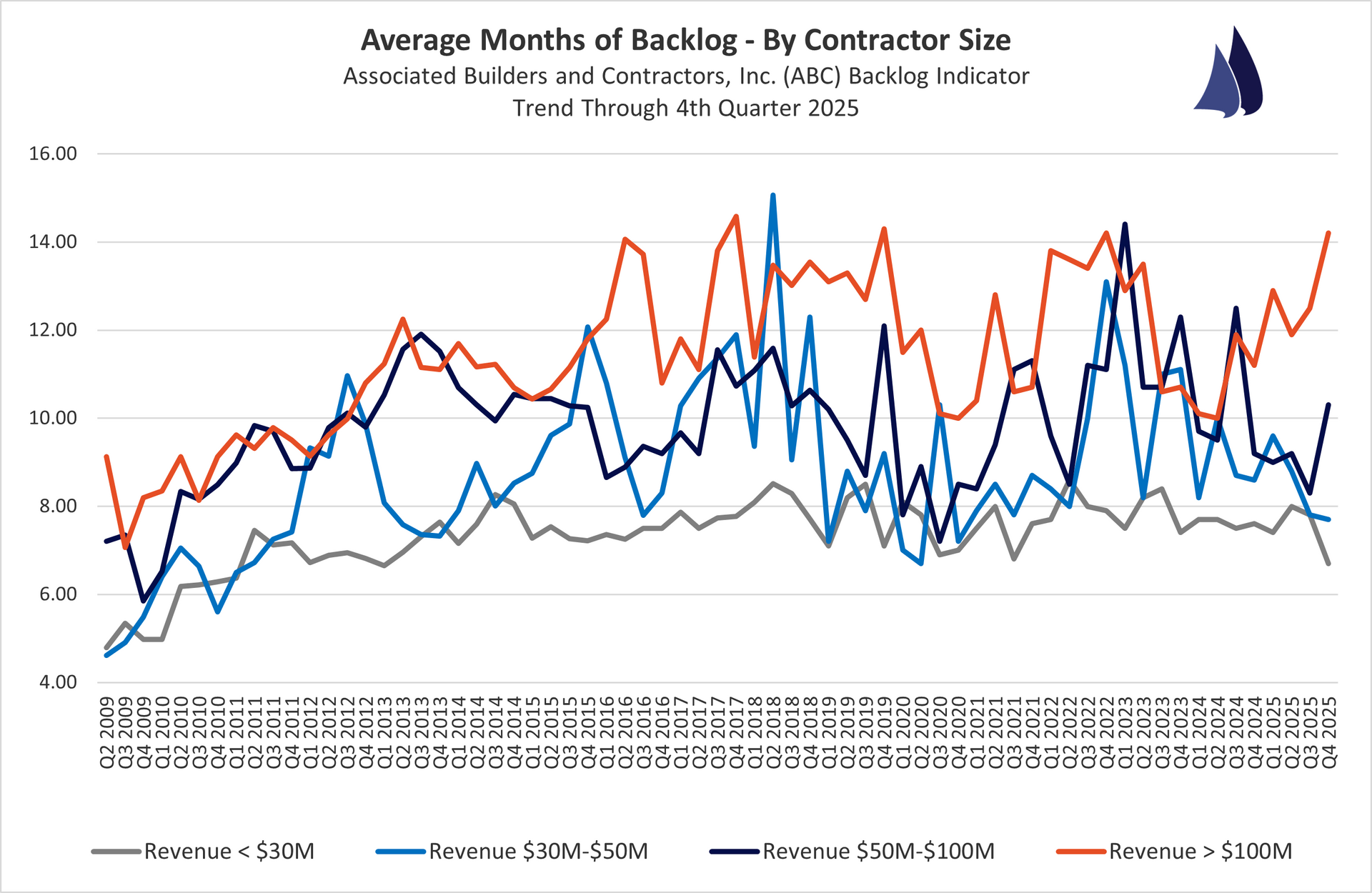

Contractor Backlogs

ABC Backlog Indicator

December 2025 (4rd Quarter)

National Avg. Backlog: 8.2 months

Backlog By Region:

South: 9.8 months | Northeast: 7.5 months | Middle States: 7.5 months | West: 7.2 months

Backlog By Company Revenue:

<$30 Million: 6.7 months | $30-$50 Million : 7.7 months | $50-$100 Million: 10.3 months | >$100 Million: 14.2 months

Backlog By Industry:

Commercial & Institutional: 8.4 months | Heavy Industrial: 6.7 months | Infrastructure: 9.1 months

Quick Analysis:

In December 2025, ABC’s Construction Backlog Indicator showed contractors carrying an average of 8.2 months of backlog nationwide, signaling generally solid forward-looking demand entering 2026. Regional results were led by the South at 9.8 months, while the Northeast and Middle States each reported 7.5 months and the West trailed slightly at 7.2 months. Backlogs were highest among larger firms and infrastructure-focused contractors, with companies over $100 million in revenue reporting 14.2 months of backlog and infrastructure work averaging 9.1 months, compared to shorter backlogs in heavy industrial and smaller contractor segments.

http://www.abc.org/NewsMedia/ConstructionEconomics/ConstructionBacklogIndicator/

Data Which Reflects Where the Industry Is Headed

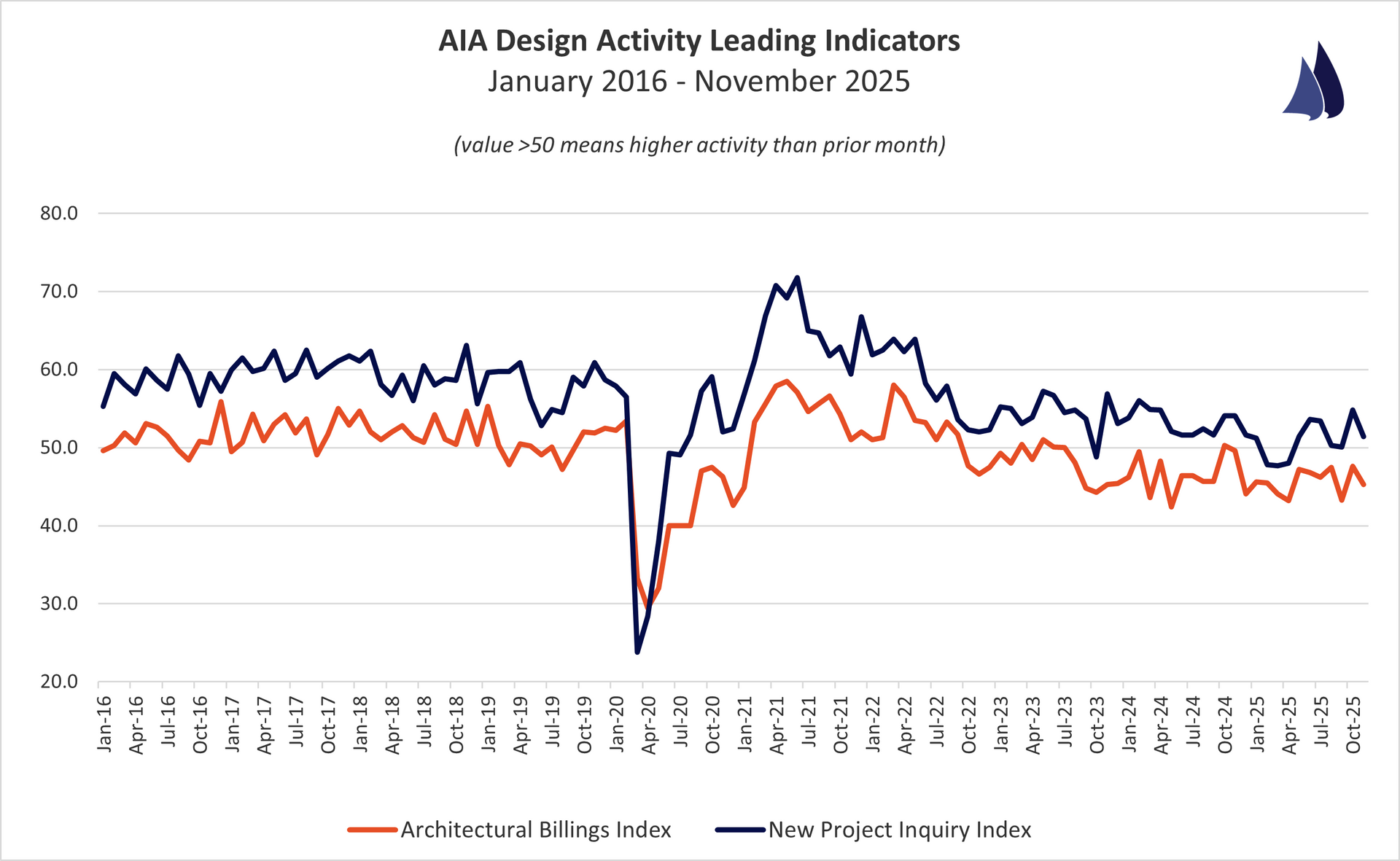

Architectural Billings

AIA Architectural Billings Index

December 2025

Architectural Billings Index (ABI): 48.5

New Design Contract Index (DCI): 47.5

Commercial/Industrial ABI: 45.2

Institutional ABI: 48.7

Multi-Family Residential ABI: 45.5

Mixed Practice ABI: 44.0

South Region ABI: 47.7

West Region ABI: 45.3

Midwest Region ABI: 51.7

Northeast Region ABI: 44.2

New Project Inquiry Index (NPII): 52.9

Quick Analysis:

Index value > 50 represents that architects have reported more activity for that particular metric than the prior month. These metrics are leading indicators as the ABI reflects projects in design that will enter the construction phase in 9 to 12 months and the NPII reflects new project demand from owners to potentially enter the design phase.

In December 2025, the AIA Architectural Billings Index registered 48.5, indicating a contraction in overall architectural billings and continued softness in near-term design activity. Sector readings remained largely negative, with commercial/industrial, multifamily residential, and mixed practice firms all below 50, while institutional work was closer to stabilization at 48.7. Regionally, the Midwest stood out with expansionary momentum at 51.7 and new project inquiries remained positive at 52.9, suggesting early-stage demand even as billings continued to lag.

http://new.aia.org/press-releases